Professional US CPA | IRS CAA Team

Your Trusted Partner for US Business & Tax Solutions

Professional US CPA | IRS CAA Team

Your Trusted U.S. Business Partner

From Formation to Compliance

US Company Registration · Tax Filing· ITIN Application · Bank Account · Trademark Registration · Annual Report & Dissolution

Smart Deductions . Stay Compliant,Pay Less

Our Key Services

Mail Handling Service

✔︎ No Monthly Fee

✔︎ Free Physical Address

✔︎ Ship your Items Anywhere

✔︎ IRS Offical Document Handing

✔︎ Educational Certificate Receiving

✔︎ Amazon Package Receiving

✔︎ Government Letter Scanning

✔︎ Bank or Credit Card Forwarding

✔︎ S.F. Express Back to China

✔︎ Inspection & Photo Services

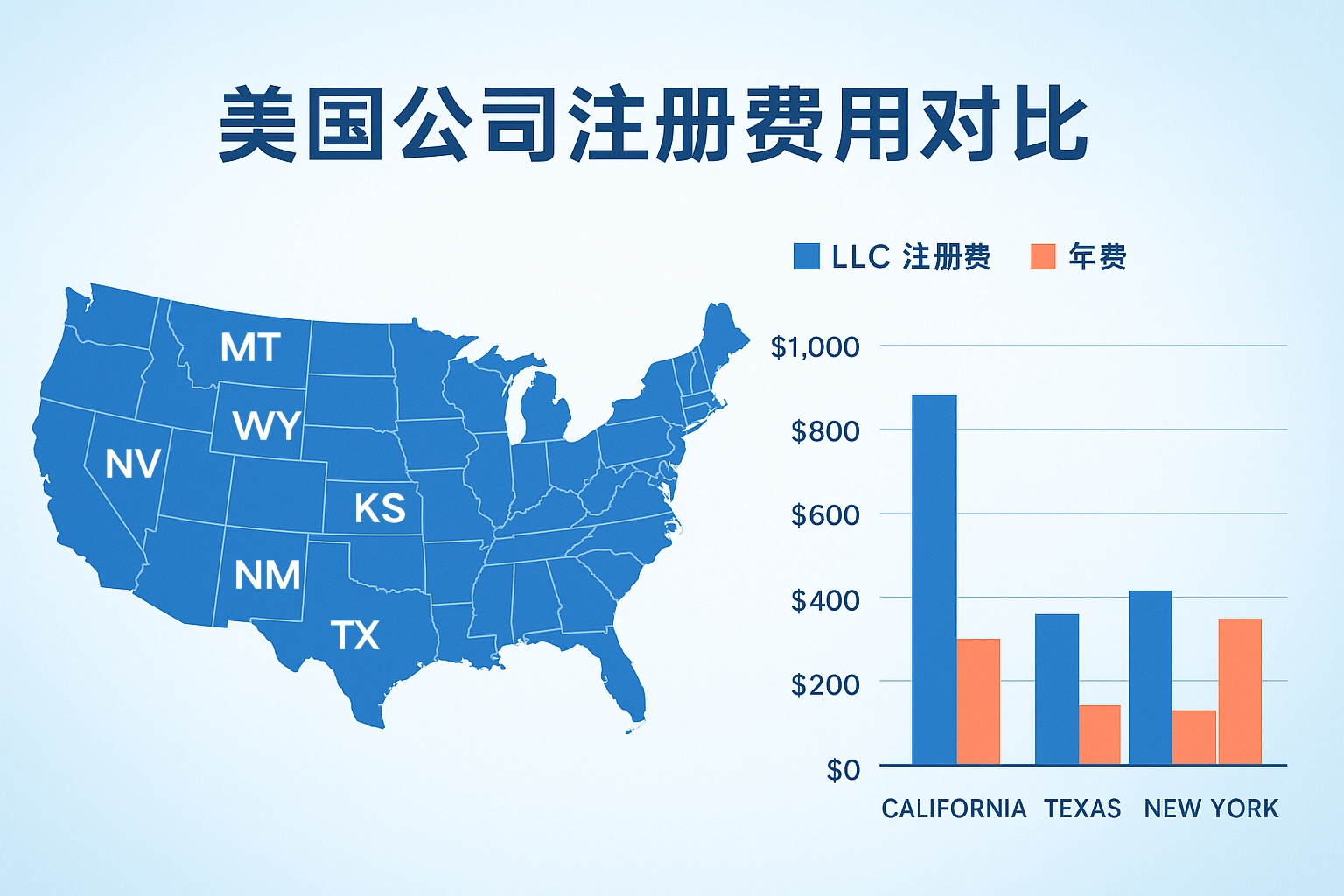

Top US States to Incorporate In

Pricing Plans for Register US Company

Our Advantages

Professional Team

Our core strength lies in our U.S.-licensed CPAs, experienced tax advisors, and bilingual business consultants. We understand both U.S. regulations and the unique needs of international clients,15+ years of industry experience

Client-First Approach

Your success is our priority. Whether you’re starting a business,or filing taxes,we provide tailored solutions for every case,fast and responsive service,long-term support for your growth

Efficient Process

No more confusing paperwork or endless delays. Our systems are optimized with simple steps, clear instructions,fast turnaround times;Remote, paperless service options

Transparent Pricing

We believe in honesty and clarity. All our service fees are listed upfront — with no hidden costs or surprise charges:Clear pricing for each service,No hidden fees;free consultation before you commit

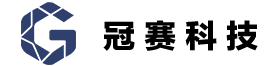

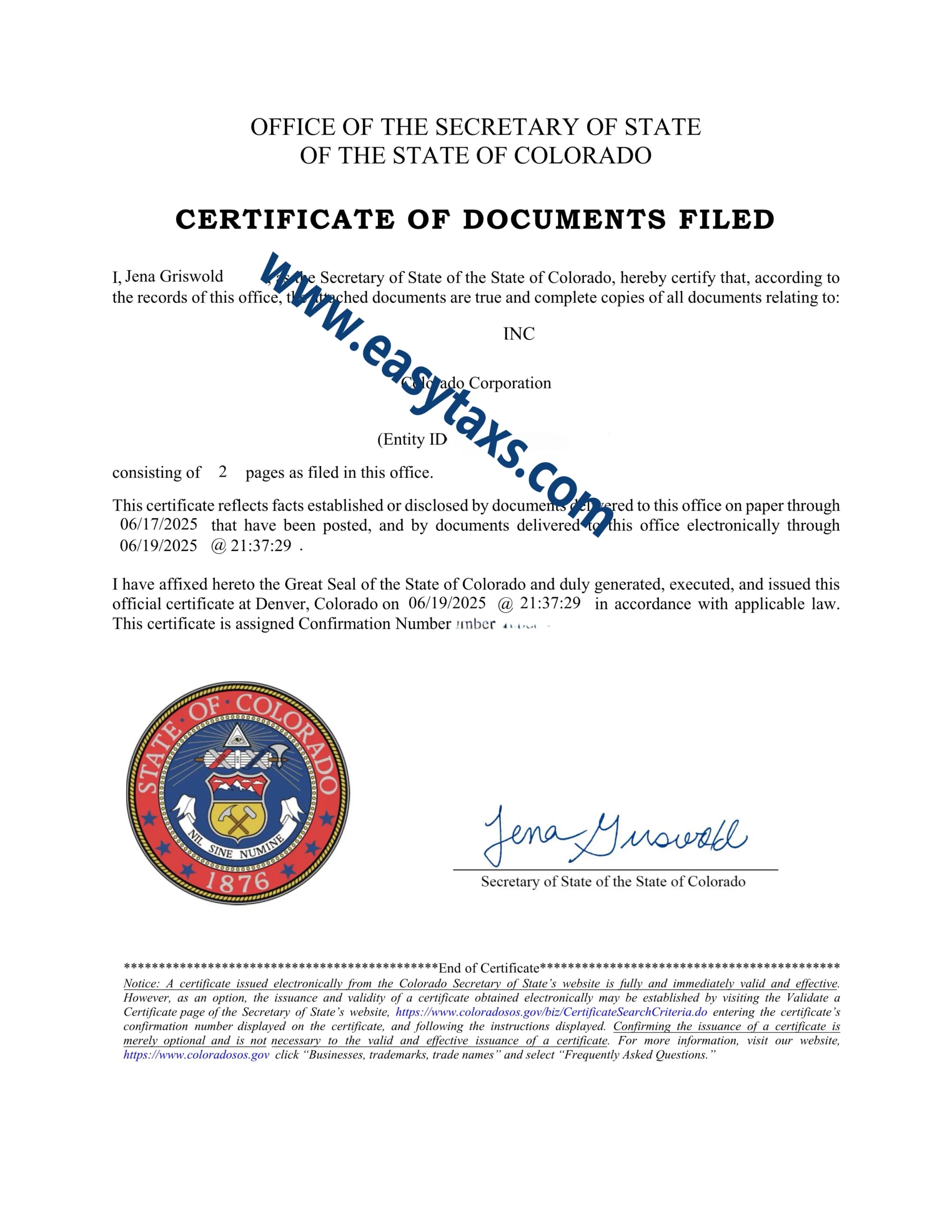

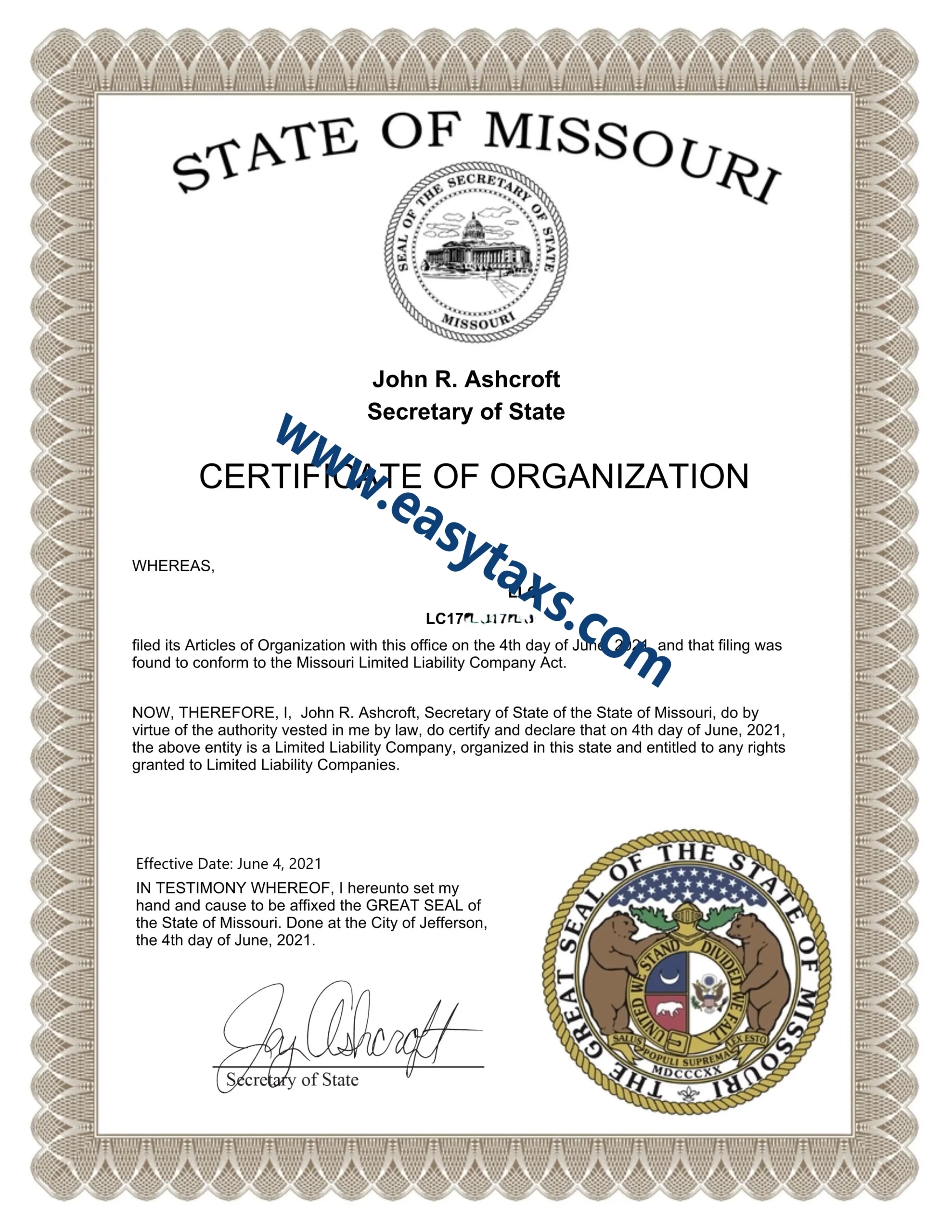

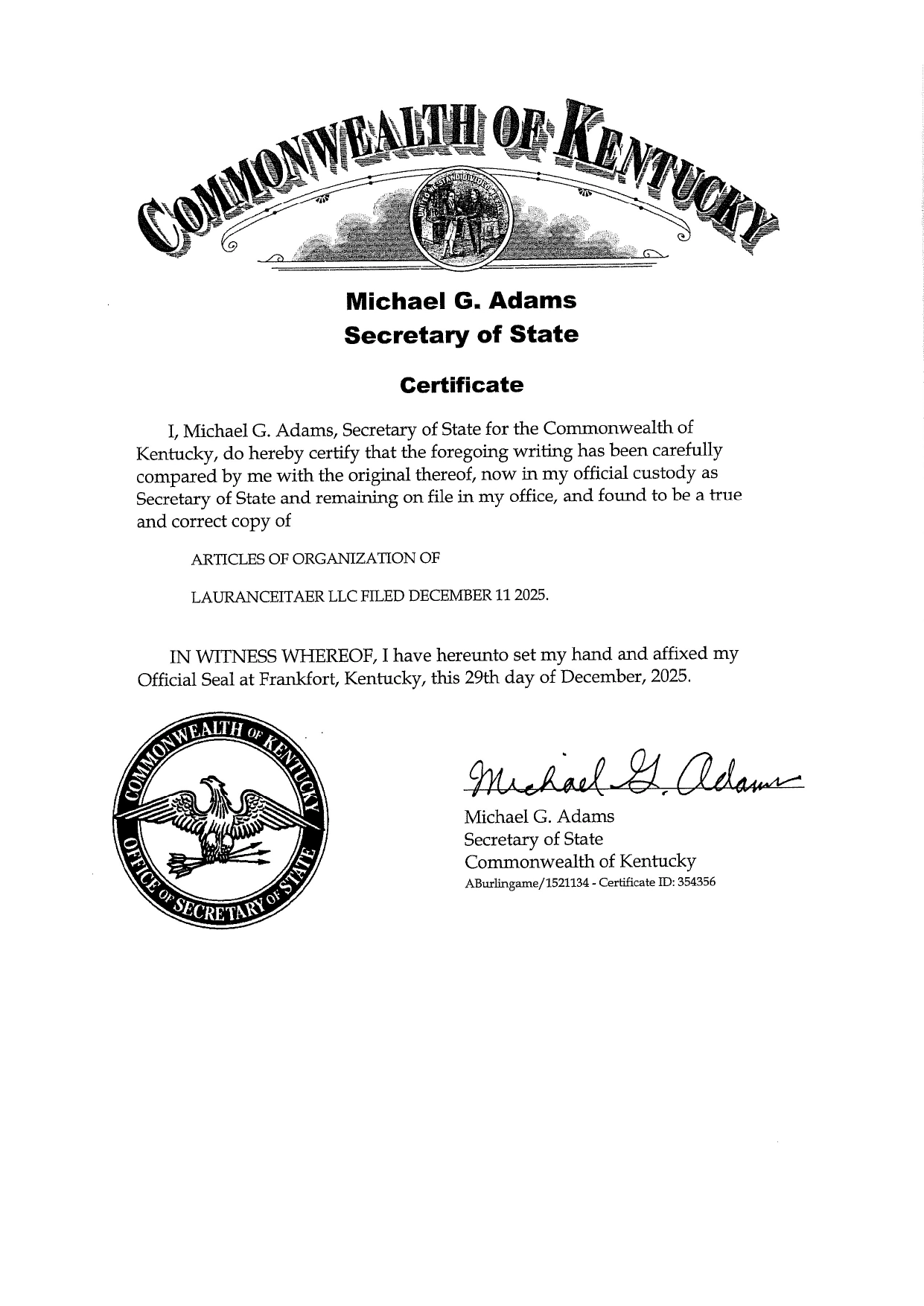

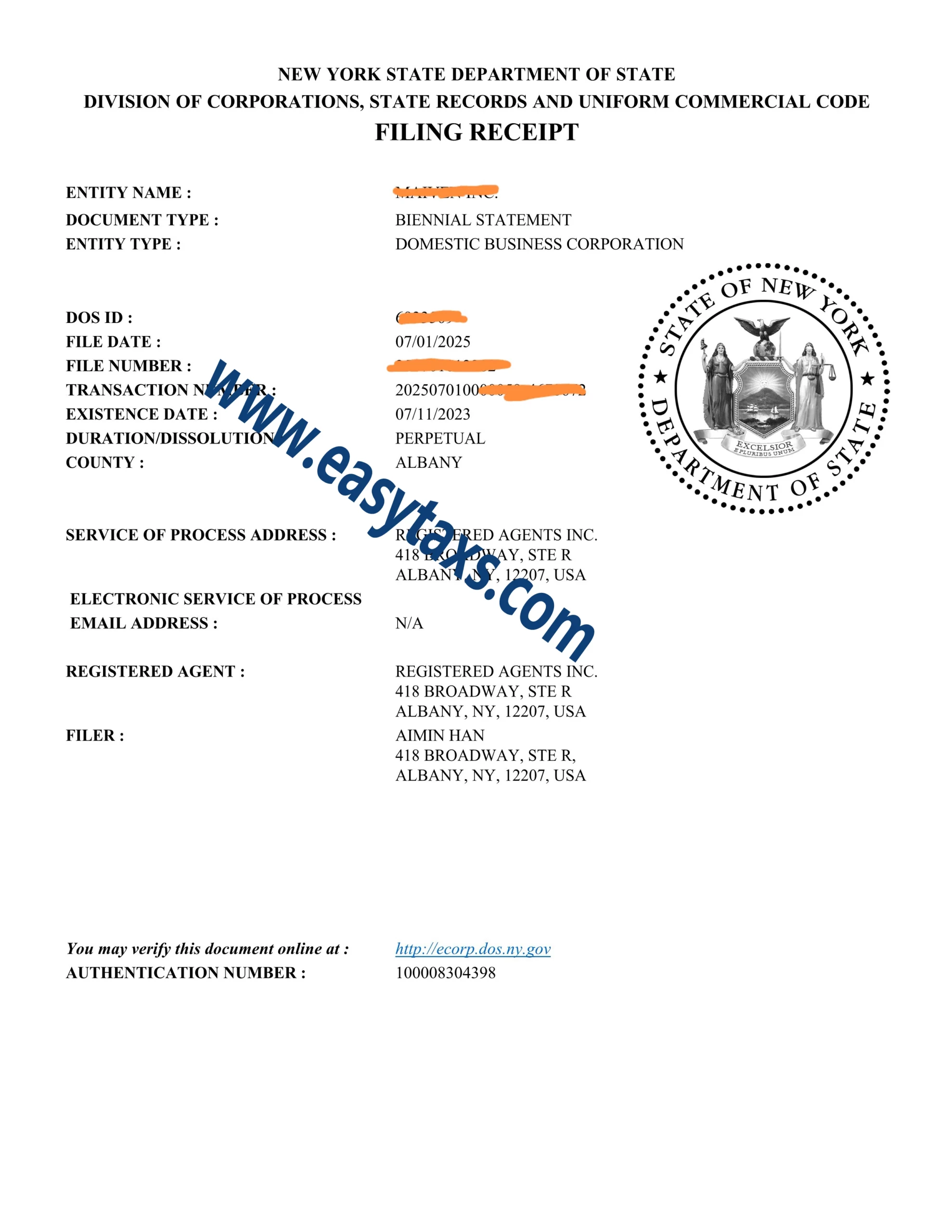

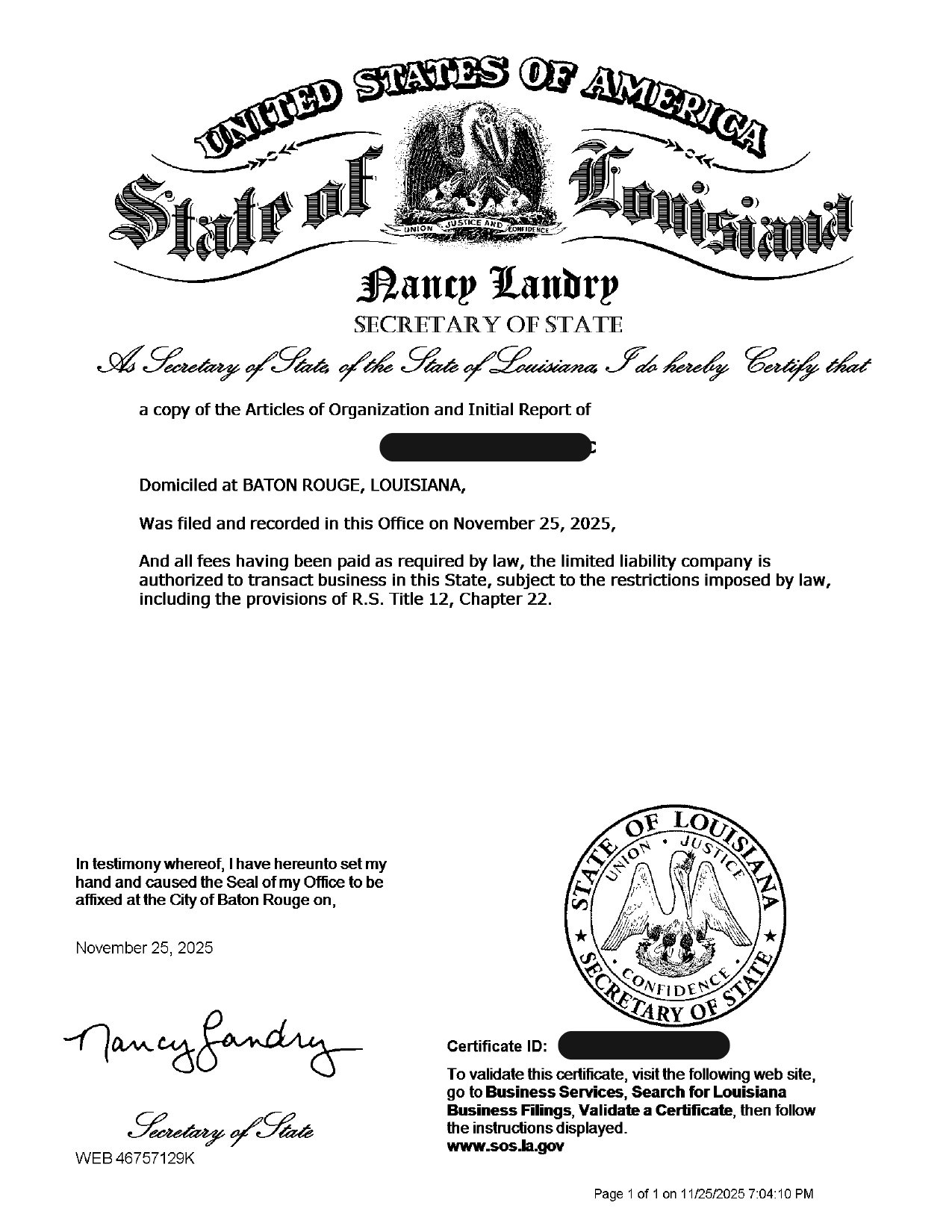

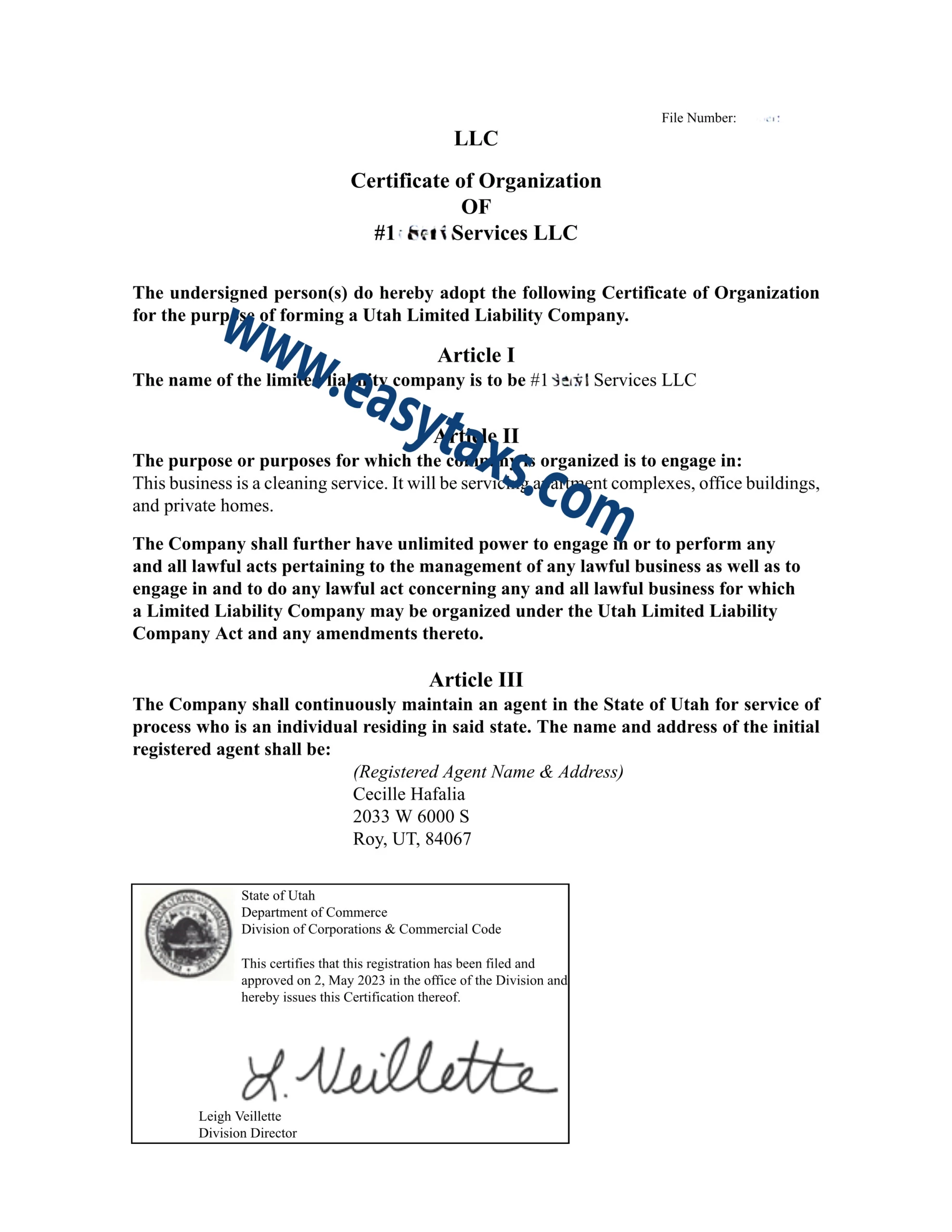

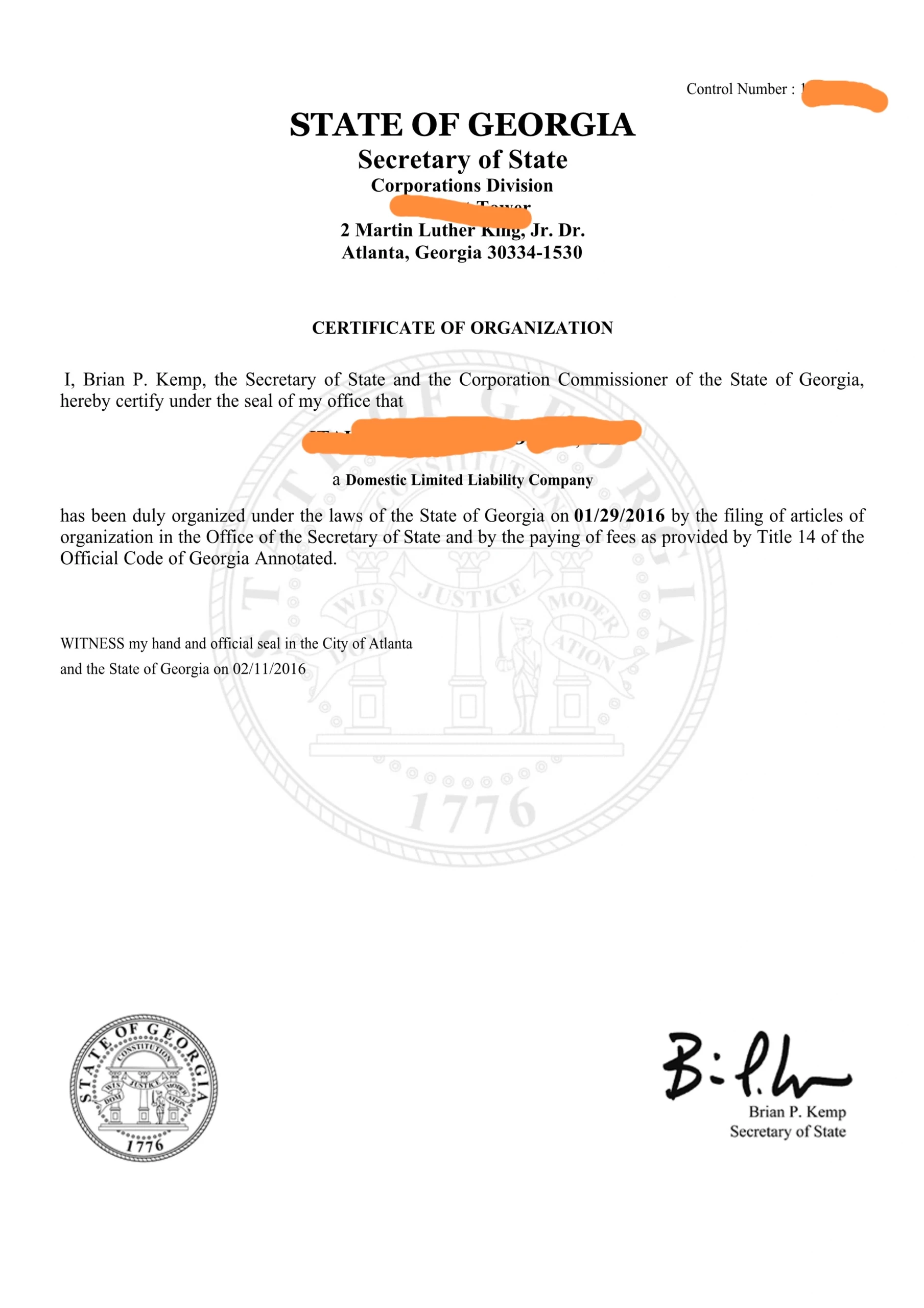

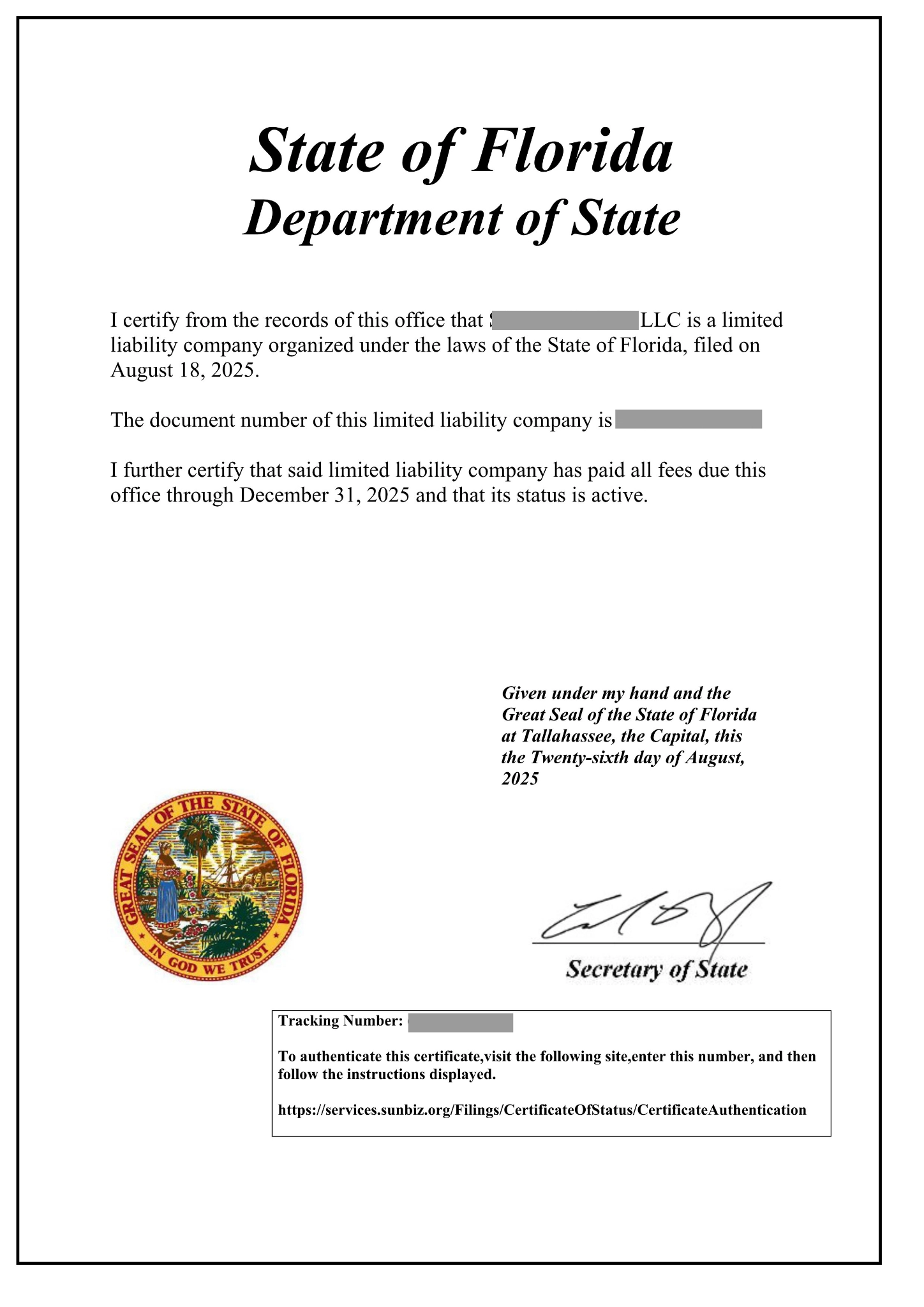

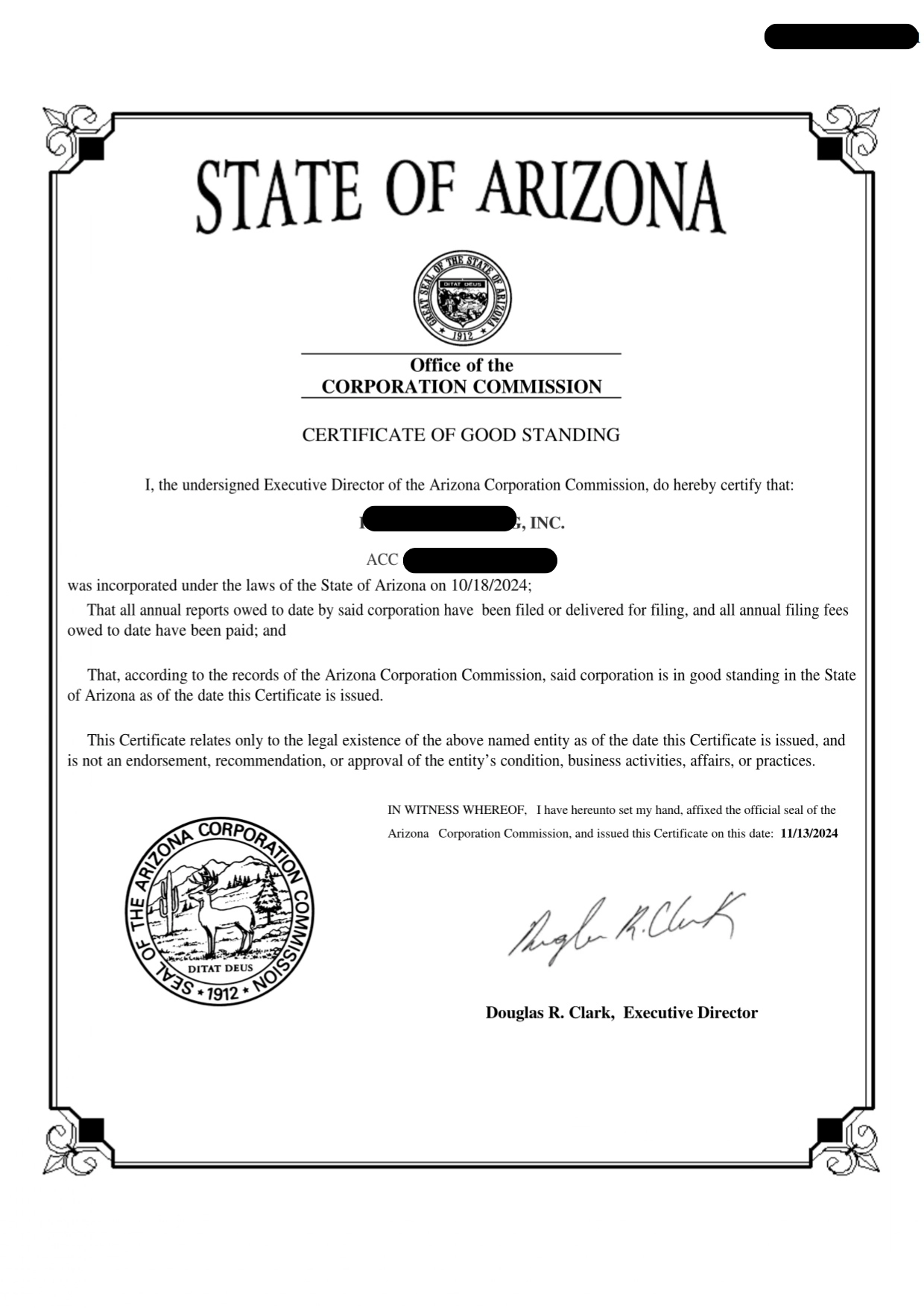

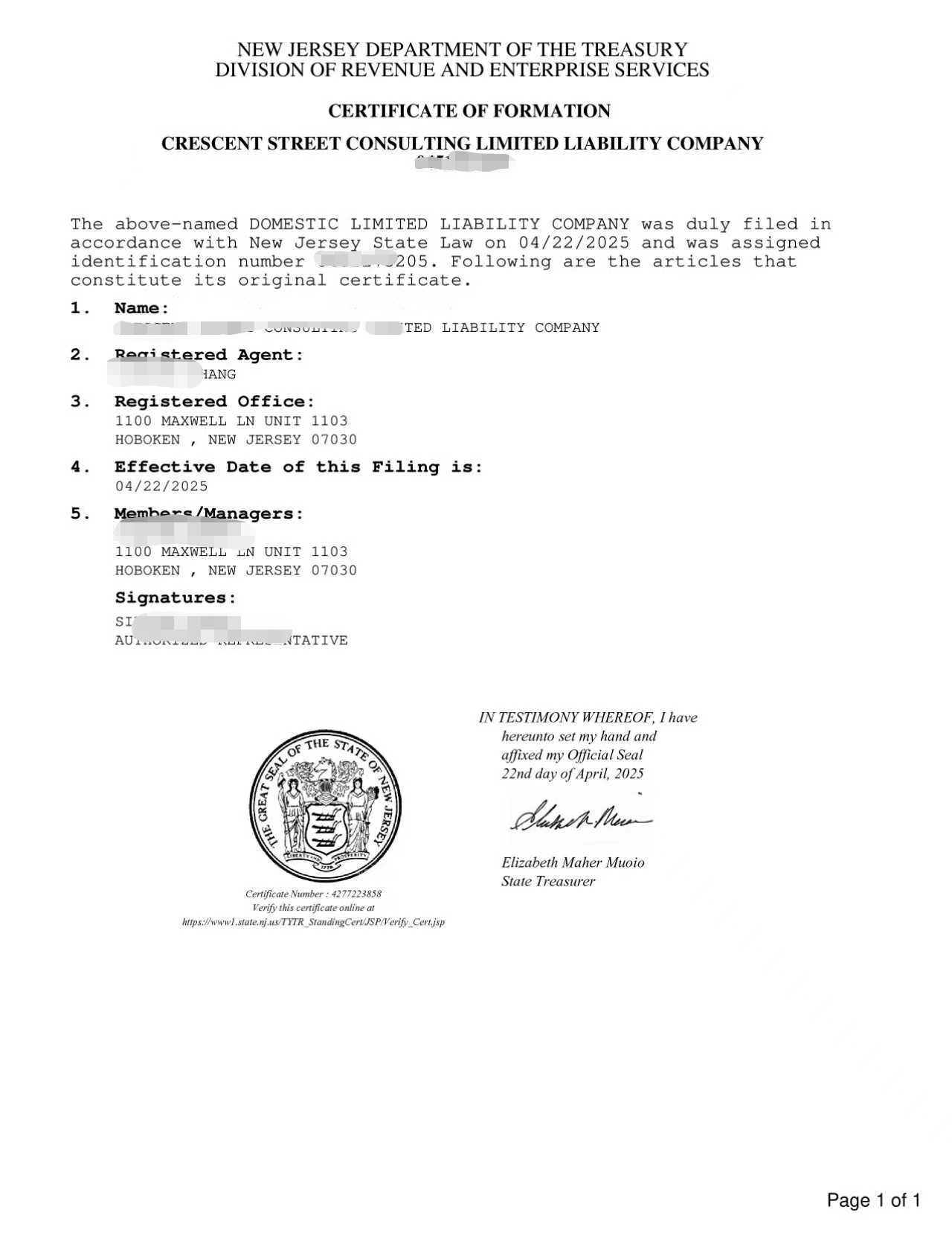

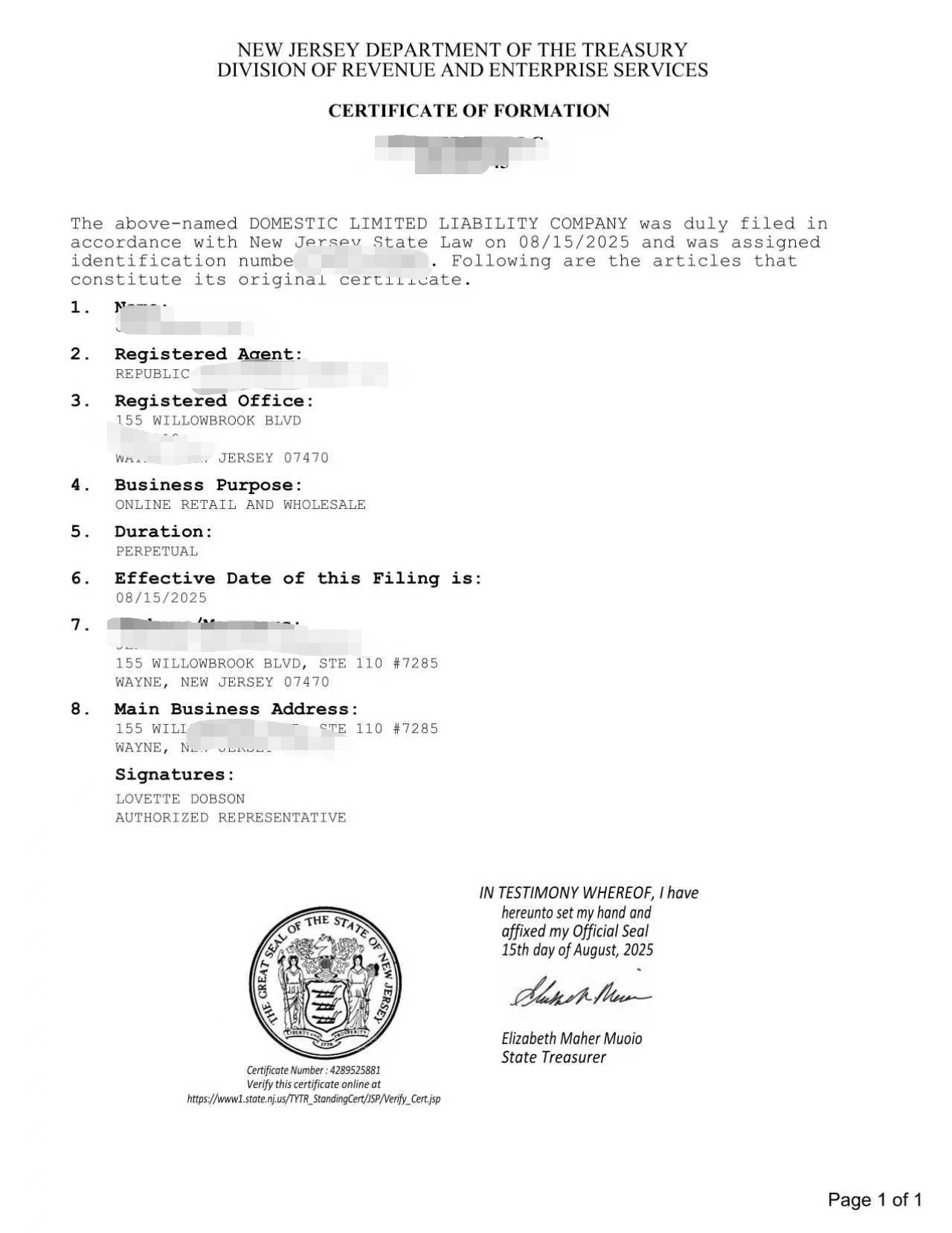

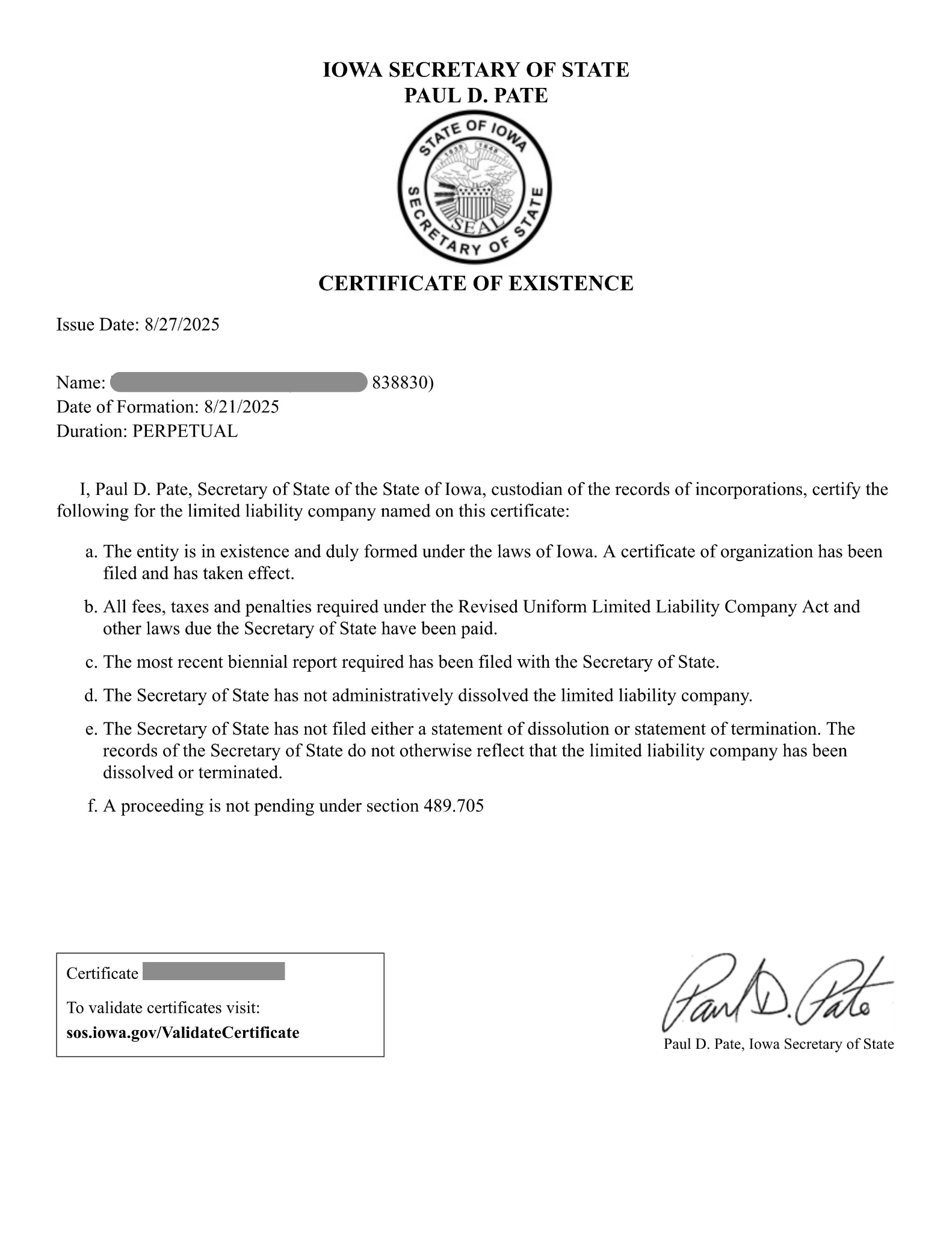

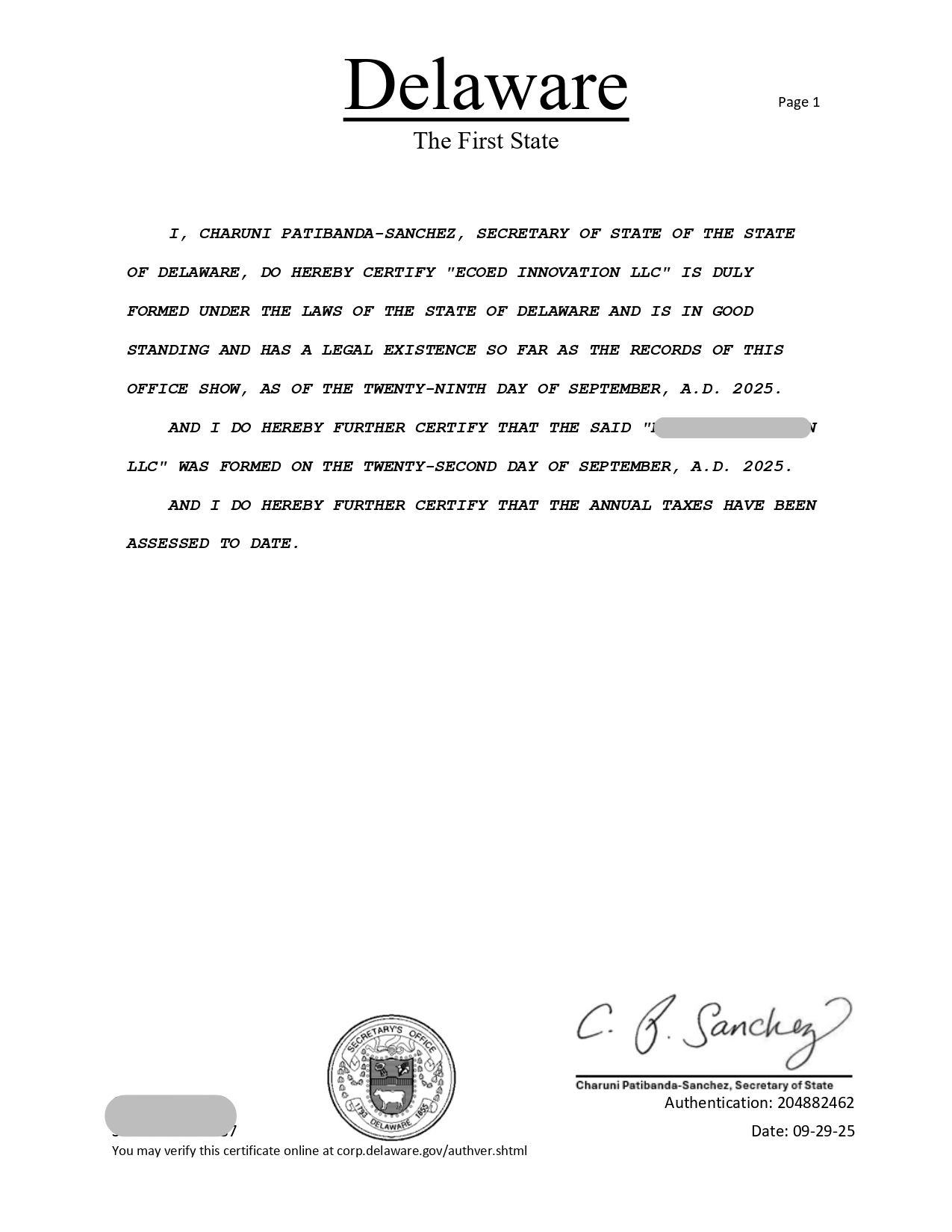

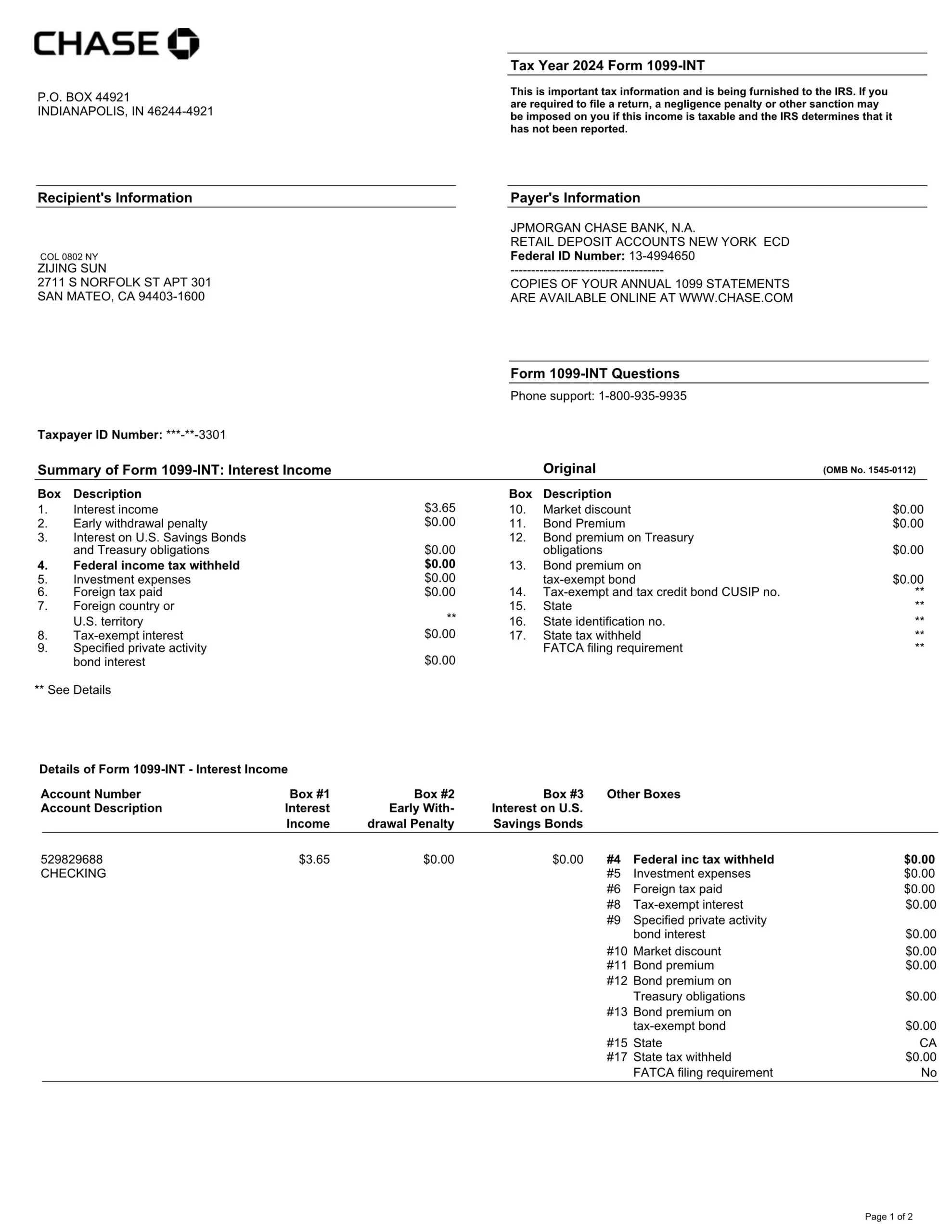

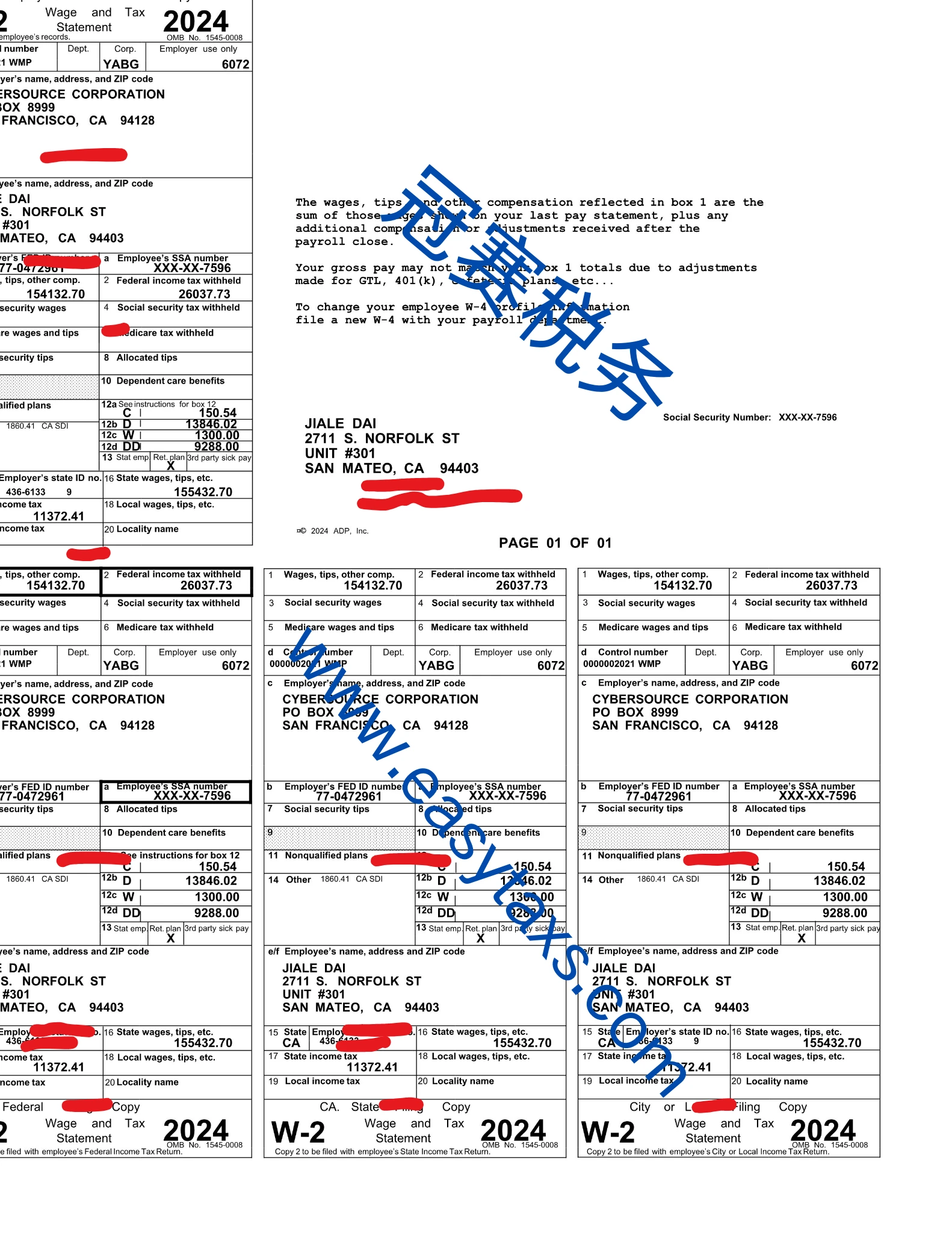

Business Registration Showcase

Why Choose Us?

Bilingual Support,Seamless & Compliant Process

Contract Backed,Full Refund guarantee,No Hidden Fees

50 States Covering Register Agent,Physical Mailing Address Service

One-stop Solution from Registration to Taxes,Compliance and Closure.

soeasytaxs@gmail.com

Mobile

+8618038173631

StartBizUSA

Our Experts

ENSURING YOUR SYSTEMS ARE OPTIMAL

Our Company’s Mission & Vision

Our Mission:

We are committed to providing professional, efficient, and reliable U.S. business and tax services to clients worldwide, becoming a trusted partner in your U.S. market journey. Understanding the complexities of cross-border operations, we focus on simplifying processes and offering clear guidance to help your business take root and thrive in the United States.

Our Vision:

To become a globally leading platform for cross-border business services—empowering ambitious enterprises and individuals to overcome international barriers, integrate global resources, and achieve sustainable growth through our expertise, innovative technology, and client-centered approach.

ENSURING YOUR SYSTEMS ARE OPTIMAL

Our Expert Team & Core Strengths

Our strength comes from a passionate, experienced team—U.S.-licensed CPAs, attorneys skilled in corporate and tax law, and consultants familiar with the U.S. business environment. With solid expertise and real-world experience, we stay current with U.S. regulations to provide compliant, up-to-date solutions.

We offer full-service U.S. company formation support—from entity selection and registration to bank account setup, annual filings, and compliance. We also handle ITIN applications for non-U.S. residents and provide tax filing, planning, and advisory services. Understanding each client’s unique needs, we deliver tailored, professional support to help you succeed in the U.S. market.

People Matter At Avada

Quisque blandit dolor risus, sed dapibus dui facilisis sed. Donec eu porta elit. Aliquam porta sollicitudin ante, ac fermentum orci mattis et. Phasellus ac nibh eleifend, sagittis.

How to Choose a U.S. Company Type? LLC or Inc?

Why is Inc better than LLC for Chinese?

LLC is a pass-through entity, meaning profits are taxed on members’ personal returns. For Chinese owners without U.S. tax IDs (SSN or ITIN), filing is complicated and may cause double taxation (U.S. + China). In contrast, U.S. residents benefit from LLCs by paying tax only once at the personal level.

Inc (C-Corp) is a separate taxable entity.

C-Corp files its own taxes, so shareholders don’t report profits annually unless receiving dividends. Chinese non-resident shareholders (NRA) who don’t meet the substantial presence test aren’t required to file U.S. personal taxes if they don’t receive wages or dividends, making compliance simpler and clearer.

For many entrepreneurs, registering a company in the US is a key step toward launching a new business chapter and entering the global market. However, one of the most practical and confusing questions is: How much startup capital is actually needed? The answer varies greatly,it depends on which state you choose to register in. Each

Many overseas Chinese who live, work, or invest in the United States often face a challenging problem: the same income may be taxed both in China and in the US,a situation known as double taxation. Without understanding the relevant tax policies, individuals may not only face higher financial burdens but also risk IRS penalties due

When you register a US company, you typically incorporate in one state. As your business grows, you may want to expand into other states. This is where interstate business operations come into play. A common question arises: Do I need to register a new company in another state?Legally, this process is called Foreign Qualification. If

Shenzhen Guansai Technology’s core team—U.S. CPAs, experienced lawyers, and cross-border consultants—has 15+ years in the U.S. market. With offices in Shenzhen, New Jersey, and Georgia, we have a 98% repeat rate and over 5,000 clients, ensuring full compliance. Our China-U.S. teams work seamlessly with 24/7 bilingual support, starting services within 2 business days and leading in document approval rates.

Shenzhen Guansai Technology Co.,Ltd

Email: hi@easytaxs.com

Mobile:+8618038173631

Headquarters:2nd Floor, Building B9, 1983 Creative Town, Nanwan Street, Longgang, Shenzhen

Georgia Branch:1367 Arlene Ct SW, Lilburn, GA 30071-4303

Frequently Asked Questions