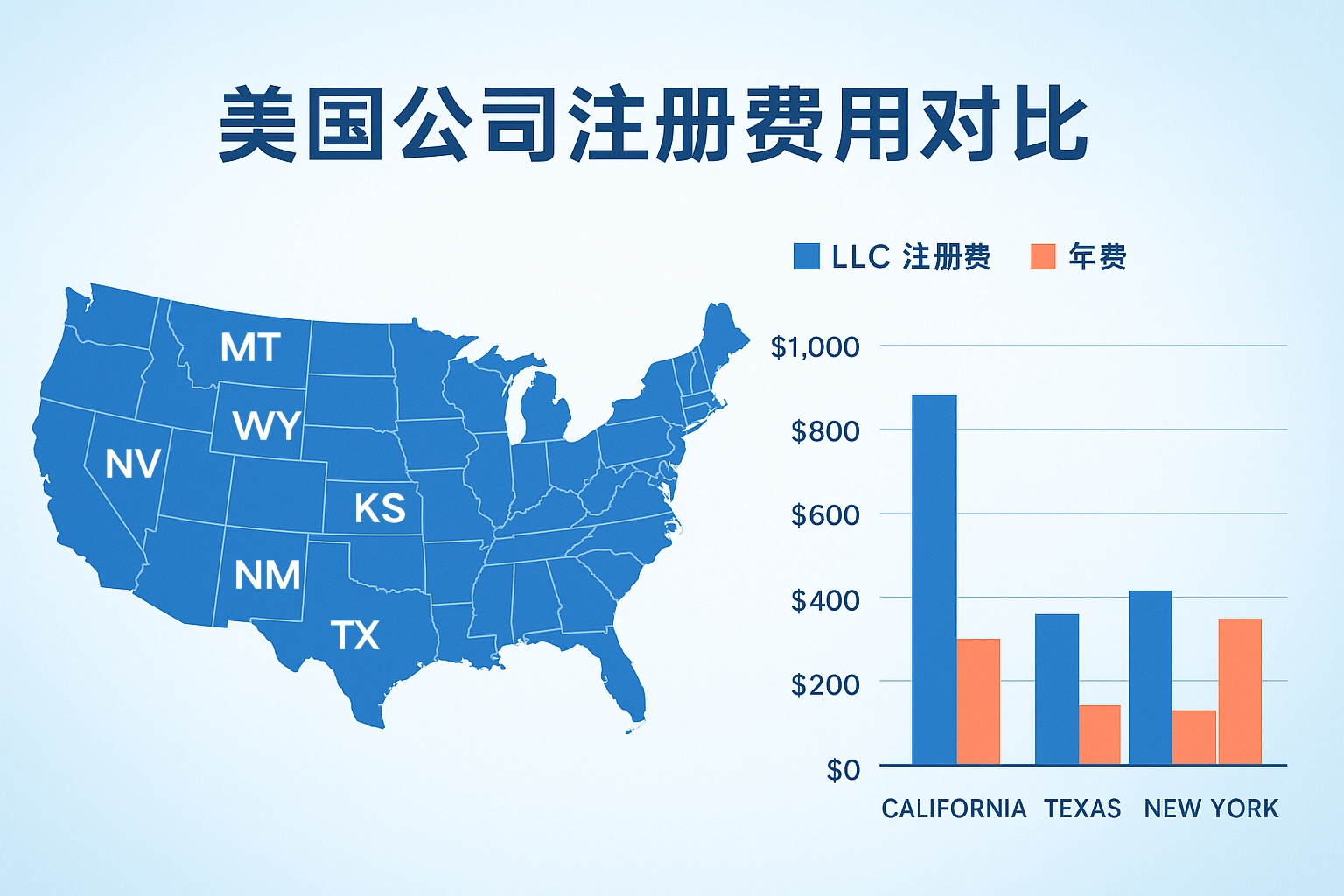

For many entrepreneurs, registering a company in the US is a key step toward launching a new business chapter and entering the global market. However, one of the most practical and confusing questions is: How much startup capital is actually needed? The answer varies greatly,it depends on which state you choose to register in. Each

Many overseas Chinese who live, work, or invest in the United States often face a challenging problem: the same income may be taxed both in China and in the US,a situation known as double taxation. Without understanding the relevant tax policies, individuals may not only face higher financial burdens but also risk IRS penalties due

When you register a US company, you typically incorporate in one state. As your business grows, you may want to expand into other states. This is where interstate business operations come into play. A common question arises: Do I need to register a new company in another state?Legally, this process is called Foreign Qualification. If

Registering a US company in 2025 is undoubtedly one of the top choices for entrepreneurs and business owners looking to expand overseas. The US market, with its massive consumer base, mature capital markets, flexible tax system, relatively simple company registration process, low maintenance costs, strong intellectual property protection, and transparent legal framework, continues to attract

Recently, we have met quite a few applicants who tried to apply for an ITIN application on their own but were rejected multiple times. Many eventually reached out to our IRS authorized CAA (Certifying Acceptance Agent) for help. Some clients were even rejected three times, wasting almost 9 months in the process. This is extremely

Every year, over 30% of Chinese business owners get into trouble due to confusing US company annual report with US company tax filing, resulting in company dissolution, frozen cross-border e-commerce accounts,or fines. This article will break down the essential differences in plain language, helping you maintain compliance in your cross-border business. US Company Annual Report

When you plan to register a US company, one of the first and most confusing questions for many cross-border e-commerce entrepreneurs is: LLC or C Corp or S Corp? Choosing the wrong structure can lead to higher tax burdens and even affect your future compliance operations. Many business owners only discover during tax season that

Step 1: Choose the type of US company to registerThe most common types of US companies for Chinese nationals are LLC and C Corporation (C Corp). An LLC is a Limited Liability Company,while a C Corp is a stock corporation. LLC company names usually end with LLC, whereas C Corp companies typically end with Inc,Corporation,Incorporated

When registering a US company, choosing the right state is key. The right choice can significantly reduce annual maintenance costs and save on various state taxes. Selecting a state with the most favorable tax structure,rather than blindly following trends,means you start your business ahead from day one. Among the 50 states, Colorado, Delaware, and California

The annual US individual tax filing season can be a daunting experience for many, whether you are a newcomer to the United States or a long-term resident.Navigating the complex tax regulations, various IRS forms, and understanding how to determine your tax filing status can be confusing. Which incomes need to be reported? What deductions can