LLC or C Corp?How to Choose? A Must-Read Guide for Registering a US Company

When you plan to register a US company, one of the first and most confusing questions for many cross-border e-commerce entrepreneurs is: LLC or C Corp or S Corp? Choosing the wrong structure can lead to higher tax burdens and even affect your future compliance operations. Many business owners only discover during tax season that their initial choice cost them extra money – and sometimes even requires filing additional forms to change the company’s tax classification. That’s why understanding the differences, pros, and cons of LLC vs C Corp before you start your US company formation is absolutely essential.

What is a US LLC?

An LLC (Limited Liability Company) is a flexible business entity that can elect to be taxed either as a partnership or as a corporation (C Corp). An LLC has members rather than shareholders, and its structure is relatively simple, which makes it ideal for small-scale businesses.

For US-based owners, registering an LLC allows pass-through taxation,profits pass directly to the owners’personal tax returns, meaning there is no federal corporate income tax at the company level. There are no mandatory board meetings or shareholder meetings; rules can be customized through an Operating Agreement, making LLCs easy to manage for small business owners who want a simple US company registration option.

What is a C Corp?

A C Corp (C Corporation) is the standard corporation type in the United States, usually ending with Inc, Corp,Corporation, Incorporated,or Limited.A C Corp has shareholders, a Board of Directors, and corporate officers. It must file its own corporate tax return and pay federal corporate income tax (currently 21%) on company profits.

If you are a cross-border entrepreneur planning future fundraising, issuing stock to investors, or building a scalable business, a C Corp is generally the preferred choice. Its standardized share structure allows the issuance of multiple classes of stock, such as common and preferred shares, which is attractive to investors and simplifies equity transfers and employee stock option plans.

Key features of a C Corp include:

Separate legal entity – company assets and liabilities are distinct from shareholders.

Double taxation – company pays corporate tax, and shareholders pay personal tax on dividends.

Formal governance requirements – must have a board of directors, hold annual meetings, and keep corporate records.

Why C Corp is Often Better for Non-US (Chinese) Shareholders

For foreign business owners registering a US company, especially Chinese entrepreneurs, a C Corp is often more convenient than an LLC. Here’s why:

Avoid ITIN requirements: If you register an LLC and choose pass-through taxation, each foreign member must apply for an ITIN (Individual Taxpayer Identification Number) to file a US personal tax return. The ITIN process requires passport copies, notarization, and mailing documents to the IRS,costly, time-consuming, and sometimes rejected.

Simpler tax filing: With a C Corp, you only file a corporate tax return at the company level. Shareholders do not need to file US personal taxes annually, saving time, effort, and accounting fees.

Investor-friendly structure: If you plan to raise funds, bring in new partners, or transfer equity, a C Corp’s governance structure is more appealing to investors and aligns with international standards.

Many of our clients initially registered an LLC, only to later file Form 8832 with the IRS to elect C Corp taxation – an expensive and time-consuming process. If you are planning long-term operations, want to scale your business, and avoid the hassle of personal tax filing,registering a US C Corp from the start is the smartest, most cost-effective choice.

+8618038173631

hi@easytaxs.com

StartBizUSA

Please scan WeChat QR code for professional service

STAY IN THE LOOP

Subscribe to our free newsletter.

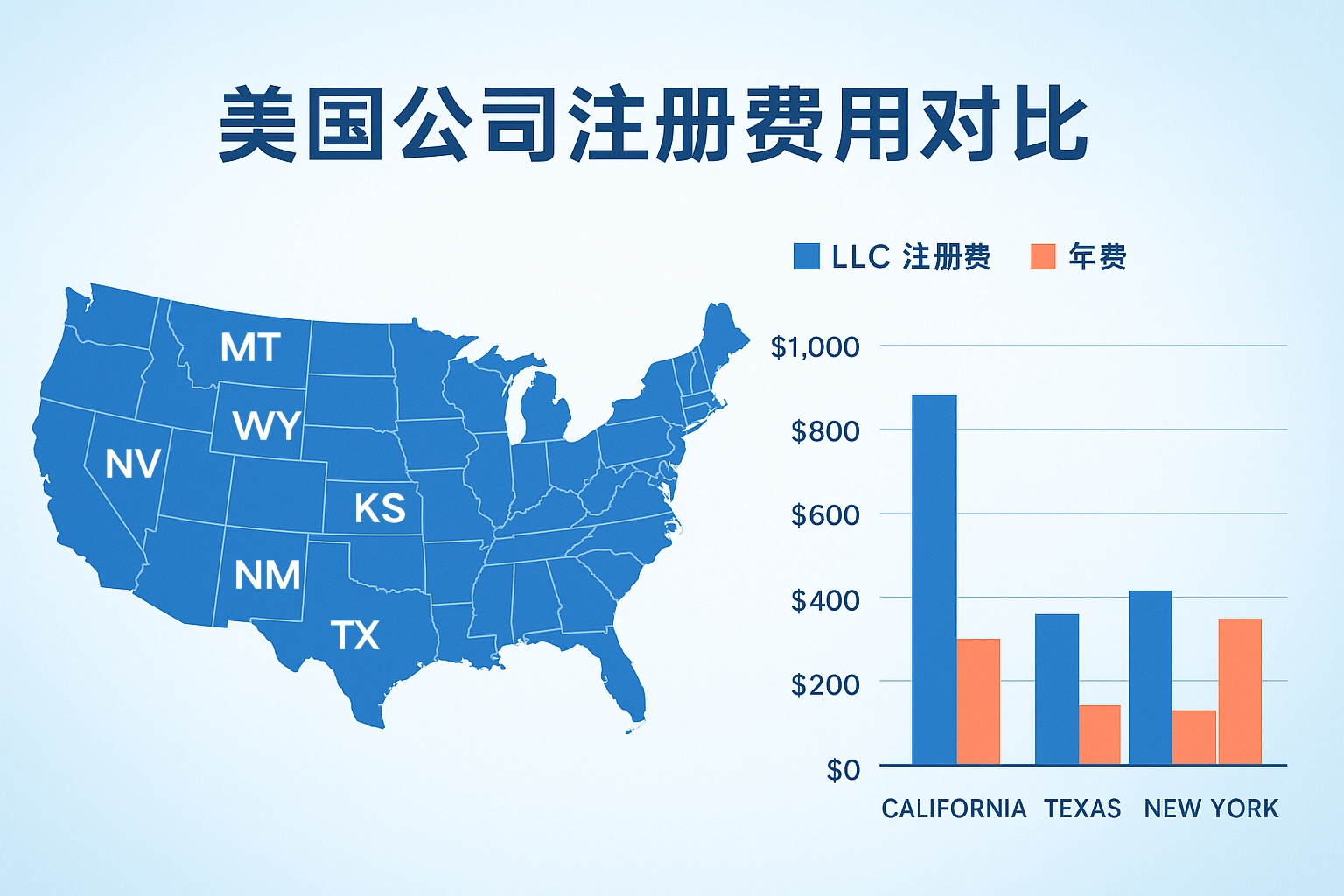

For many entrepreneurs, registering a company in the US is a key step toward launching a new business chapter and entering the global market. However, one of the most practical and confusing questions is: How much startup capital is actually needed? The answer varies greatly,it depends on which state you choose to register in. Each

When you register a US company, you typically incorporate in one state. As your business grows, you may want to expand into other states. This is where interstate business operations come into play. A common question arises: Do I need to register a new company in another state?Legally, this process is called Foreign Qualification. If

Registering a US company in 2025 is undoubtedly one of the top choices for entrepreneurs and business owners looking to expand overseas. The US market, with its massive consumer base, mature capital markets, flexible tax system, relatively simple company registration process, low maintenance costs, strong intellectual property protection, and transparent legal framework, continues to attract

Every year, over 30% of Chinese business owners get into trouble due to confusing US company annual report with US company tax filing, resulting in company dissolution, frozen cross-border e-commerce accounts,or fines. This article will break down the essential differences in plain language, helping you maintain compliance in your cross-border business. US Company Annual Report