How Can Chinese Nationals Register a US Company? Complete Process & Practical Guide

Step 1: Choose the type of US company to registerThe most common types of US companies for Chinese nationals are LLC and C Corporation (C Corp). An LLC is a Limited Liability Company,while a C Corp is a stock corporation. LLC company names usually end with LLC, whereas C Corp companies typically end with Inc,Corporation,Incorporated or Corp.

For taxation, an LLC’s tax burden is usually passed through to the individual level, meaning the company itself does not pay taxes; profits are directly reported by the shareholders on their personal tax returns. Since the shareholders are Chinese residents, an ITIN is required. Therefore, in most cases, Chinese nationals register LLCs but elect to have them taxed as C Corps to avoid applying for ITIN separately.

If an LLC is taxed as a C Corp, why not directly register as a C Corp? For Chinese nationals, registering a C Corp is generally the preferred option. As long as the company does not distribute dividends, shareholders are not subject to personal income tax. Even if dividends are issued, tax credits can be applied under the U.S.-China tax treaty to avoid double taxation, reducing the effective tax rate from 30% to as low as 10%.

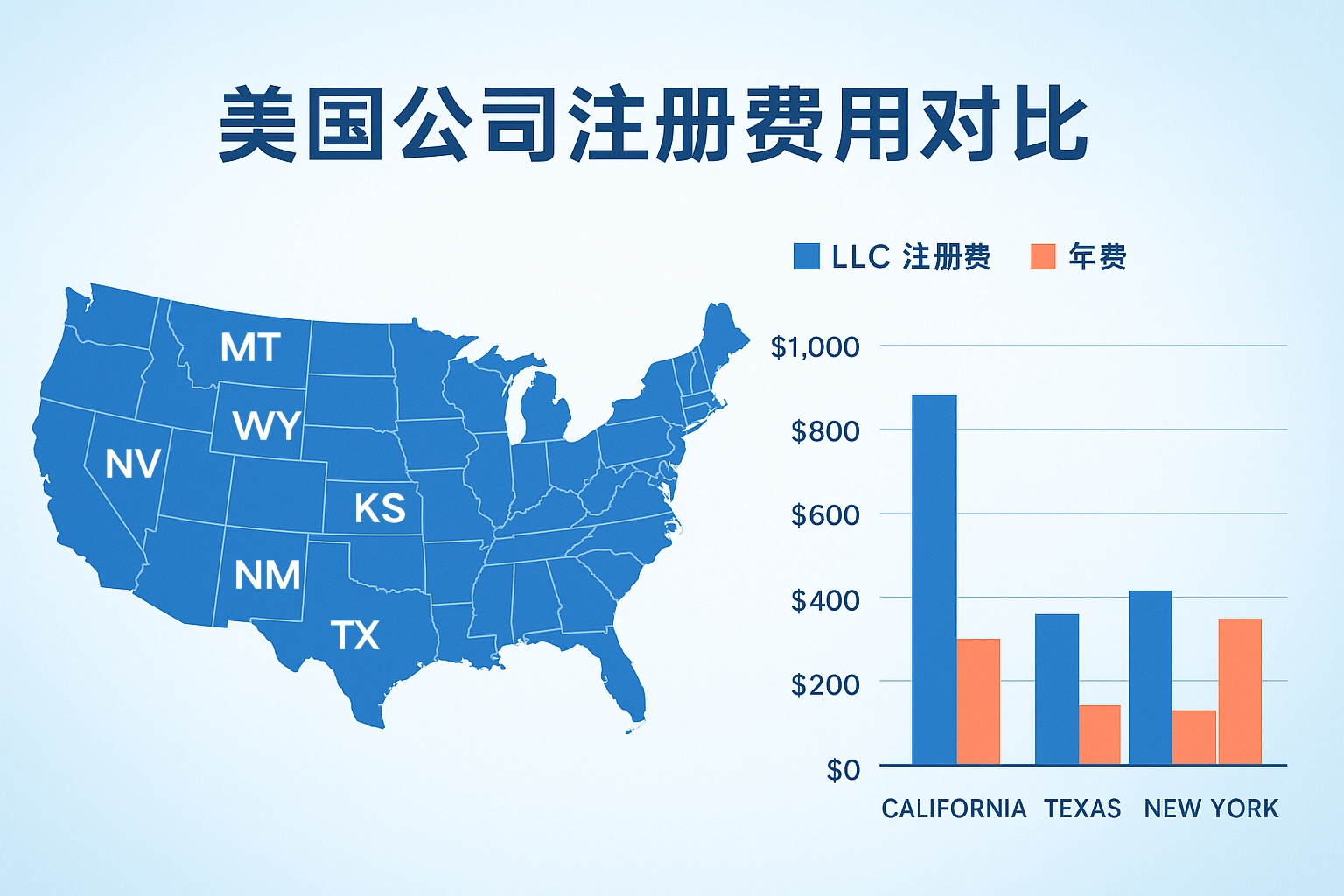

Step 2: Choose the right state for registration:Which US state should you choose for company registration? The choice should consider tax policies, registration and maintenance costs, privacy protection, and legal environment, combined with your own needs.

Common states for Chinese nationals to register US companies include: Wyoming, Delaware, Missouri, Nevada, Florida, Mississippi, Montana, Kentucky, South Dakota, and others. These states generally have low registration and maintenance costs. Currently, Wyoming is the most popular choice because it offers 0 corporate income tax, 0 personal income tax, 0 franchise tax, and low registration fees, making it highly favored by cross-border e-commerce entrepreneurs.

Step 3: Provide registration information – Once the company type and state are selected, the basic registration information must be prepared. Chinese shareholders usually need to provide identification documents (passport or ID card), with no nationality restrictions, no visa required, and no need to be physically present. US company registration does not require registered capital or capital verification.

You will also need to provide:A company name in English, which must be unique in the state (we offer free name check services).

Company members, which can be a single owner or multiple partners.Business scope, simply specifying the industry or activities.Shareholder contact information.A US registered address, which can be your own, a friend’s, or we can provide 1 year of free address service including government mail receipt and scanning.

Step 4: Submit documents and wait for state approval

Through our agency service, US company registration covers all 50 states plus DC. About 90% of US companies receive their formation documents within 3–5 business days, with free expedited service available.

Step 5: Apply for an EIN number – The EIN (Employer Identification Number) is a unique federal tax identification number for your company. Each company has its own EIN, which is used for tax filing, opening US bank accounts, and linking with cross-border e-commerce platforms. Applying for an EIN requires the company’s registration information, and through our service, the EIN can be issued in as fast as 24 hours.

+8618038173631

hi@easytaxs.com

StartBizUSA

Please scan WeChat QR code for professional service

STAY IN THE LOOP

Subscribe to our free newsletter.

For many entrepreneurs, registering a company in the US is a key step toward launching a new business chapter and entering the global market. However, one of the most practical and confusing questions is: How much startup capital is actually needed? The answer varies greatly,it depends on which state you choose to register in. Each

When you register a US company, you typically incorporate in one state. As your business grows, you may want to expand into other states. This is where interstate business operations come into play. A common question arises: Do I need to register a new company in another state?Legally, this process is called Foreign Qualification. If

Registering a US company in 2025 is undoubtedly one of the top choices for entrepreneurs and business owners looking to expand overseas. The US market, with its massive consumer base, mature capital markets, flexible tax system, relatively simple company registration process, low maintenance costs, strong intellectual property protection, and transparent legal framework, continues to attract

Every year, over 30% of Chinese business owners get into trouble due to confusing US company annual report with US company tax filing, resulting in company dissolution, frozen cross-border e-commerce accounts,or fines. This article will break down the essential differences in plain language, helping you maintain compliance in your cross-border business. US Company Annual Report